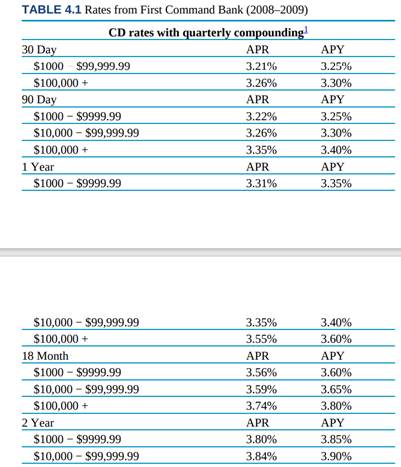

Parts b and c refer to the 2008–2009 rates at First Command Bank shown in a. Assume that a one-year CD for $5000 pays an APR of 8% that is compounded quarterly. How much total interest does it earn? What is the APY? b. If you purchased a one-year CD for $150,000 from First Command Bank, how much interest would you have received at maturity? Was compounding taking place? Explain. c. If you purchased a two-year CD for $150,000 from First Command Bank, the APY (4.05%) was greater than the APR (3.98%) because compounding was taking place. We are not told, however, what the compounding period was. Use the APR to calculate what the APY would be with monthly compounding. How does your answer compare to the APY in the table?

Â

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"